Receipts carry the information needed for trade to occur between companies and much of it is on paper or in semi-structured formats such as PDFs and images of paper/hard copies. In order to manage this information effectively, companies extract and store the relevant information contained in these documents. Traditionally this has been achieved by manually extracting the relevant information and inputting it into a database which is a labor-intensive and expensive process.

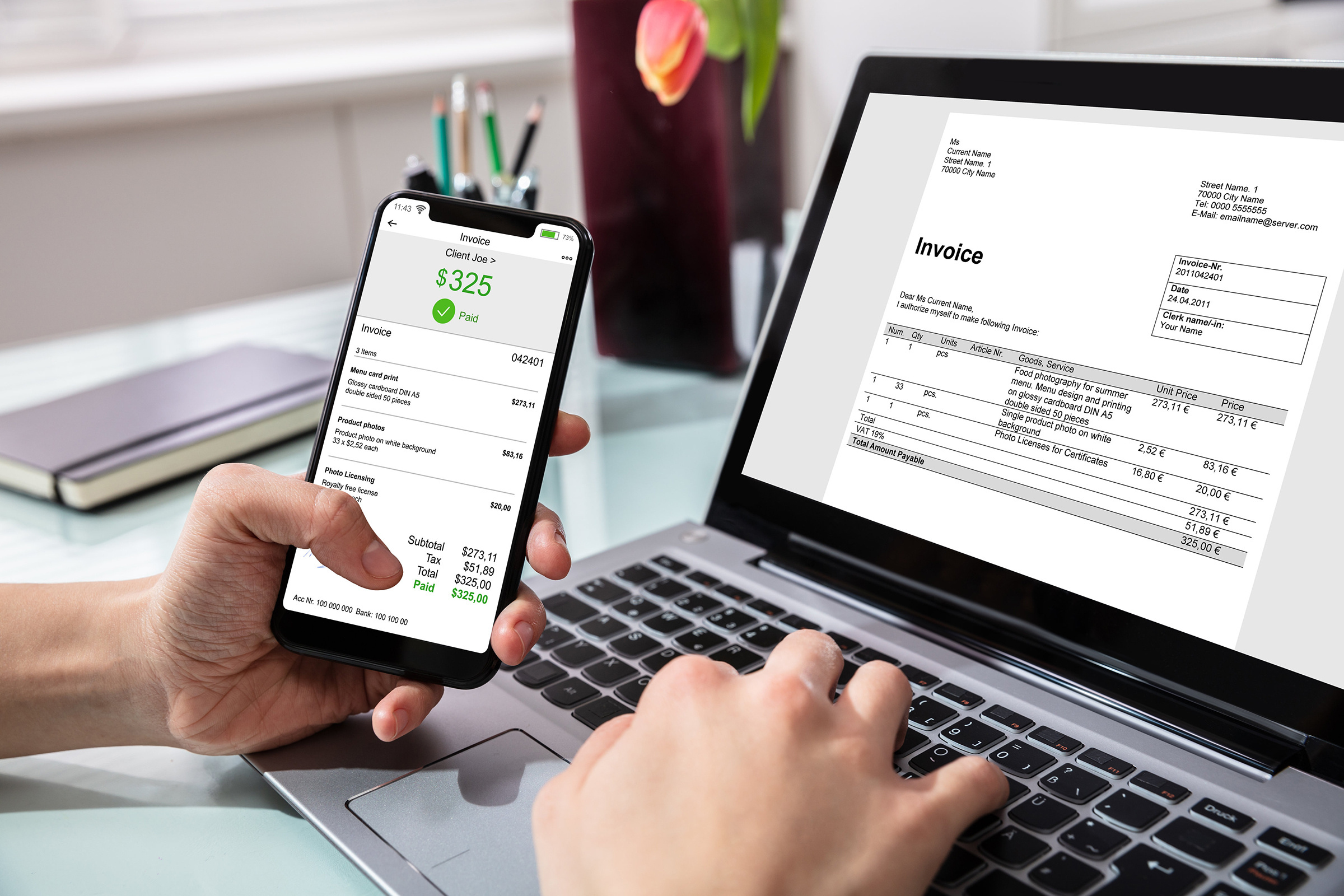

Receipt digitization addresses the challenge of automatically extracting information from a receipt.

Extracting key information from receipts and converting them to structured documents can serve many applications and services, such as efficient archiving, fast indexing, and document analytics. They play critical roles in streamlining document-intensive processes and office automation in many financial, accounting, and taxation areas.

Table of Contents

The Traditional Process

- An employee records the expenses when payment is received for a product or service. This is time-consuming and is very much prone to errors.

- Scanned or printed copies are filed for proof of expense.

- When there are many approvals required at every stage, reimbursements may occur that may be against policies.

- Long lead time with the approvals may lead to employee discontent and problems with cash-flow.

- The amount must then be entered into the account when you reimburse. This means that another manual entry, which is another chance to make mistakes.

- Copies of the approval with the original expense will be stored and if they’re printed copies then you’ll have additional costs for storage.

- You will also have problems when you pull up those data in the future and are often a futile exercise.

Digitalize your receipts and invoices:

1. Convert Print to Digital Information

The key to the success of the whole process lies in digitizing anything and everything that is possible. Without a simple, effective digitization process, it will hardly change how expenses are managed within your business.

There are basically three types of expenses or invoices – online, printed, and hand-written – and you’re supposed to work with a technology that handles each without fail. This means that downloaded or emailed online receipts can be added with little or no manual effort, and online payments are integrated immediately via a simple interface. Printed receipts are read directly from the camera on your mobile device using intelligent technologies such as Optical Character Recognition (OCR), while the required number of handwritten receipts can also be inserted manually and as easily and painlessly as needed. These digitized receipt OCR can easily be stored into the system and the numbers accounted for. It is, however, important to have a very accurate software system to capture these data. Errors or lost information will just be a headache for your financial team.

2. Integrate into the System

No matter which Enterprise Resource Planning (ERP), Human Resource Information System (HRIS), or accounting package you use, the package you choose to manage expenses must work with your existing systems. Whether it’s Sage, Microsoft Dynamics, Oracle, SAP, or a variety of new players, your legacy systems need not be burdened with any expense management solution.

3. Automate the process

Your digitization process should enable all subsequent processes to be fully editable for automation where possible. You should be able to set specific rules for your business and your approval process based on expense type, amount or dates and a multitude of other requirements and everything should be possible in-app, on a desktop, or on a mobile phone.

With 75% of business expenses incurred while on-the-go, the ability to make changes to your additional approval or immediate reimbursement needs is invaluable. Also desirable is a solution that allows for currency conversion to return the approval in native currency immediately at the time the expense was incurred. A fast, easy, and efficient workflow should be the target for consumers, whether administrators, managers, or field workers.

4. Comply with Regulations

Regardless of where you are located, financial regulations are abundant and, despite similarities and cross-border agreements, there is a great variety of nuances in tax law and thus the impact on expenditure management and reimbursement policy is huge from country to country. Even for multinationals and large cross-border teams, compliance with each country’s financial regulations that your operating businesses can be a huge problem. Apply to this the variation of specifications for data security, vocabulary, data safety, and account management … and the challenge minefield will become unmanageable. You should work with a product that begins by integrating local regulations and compliance at the capture point, while also offering the flexibility to modify.

Compliance with storage and security has always been of great importance to financial data, but recent developments, primarily the advent of the General Data Privacy Regulation (GDPR) in Europe, mean that how data is stored is no longer just a cybersecurity issue, but also the ability to identify, forget or delete an individual.

Computing Accounts payable and Accounts Receivables manually is costly, time-consuming, and can lead to confusion between managers, customers, and vendors. With digitization, companies can eliminate these drawbacks and can have more advantages – Increased Transparency, Data Analytics, Improved working capital, and easier tracking.

You can also read : Ways Dissertation Writing Service Can Help You

Conclusion

In conclusion, traditional expense management processes are manual, error-prone, and time-consuming. Digitizing receipts offers a solution by automating data extraction and integrating it with existing systems. This leads to a streamlined workflow, improved accuracy, and better compliance with regulations. Overall, receipt digitization offers significant advantages for businesses of all sizes.